Is ev charging station business profitable?

Is ev charging station business profitable

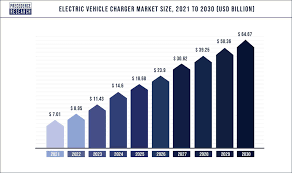

Yes, the electric vehicle (EV) charging station business can be highly profitable, driven by a powerful combination of rapidly growing market demand and significant government incentives, including tax credits. A central point supporting this profitability is the availability of tax credits for installing EV chargers. According to the U.S. Inflation Reduction Act, both businesses and individuals can apply for tax credits under specific conditions. For businesses, the policy allows a tax credit of up to 30% per charging port, with a maximum cap of $100,000. For individuals, the credit is also up to 30% of the installation cost per port, but with a lower maximum of $1,000 per charger. However, these benefits come with certain eligibility requirements. The credits are primarily available for installations located in low-income or non-urban areas, and the policy is set to remain in effect until the end of 2032. Additional support measures include waived grid upgrade fees, where the cost of electrical infrastructure improvements is covered by the utility company rather than the individual or business, and broader tax advantages for charging station companies, which indirectly reduce the overall installation and operational costs for end-users. The overarching goal of these policies is to expand the network of charging facilities, alleviate range anxiety for long-distance travel, and accelerate the adoption of electric vehicles.

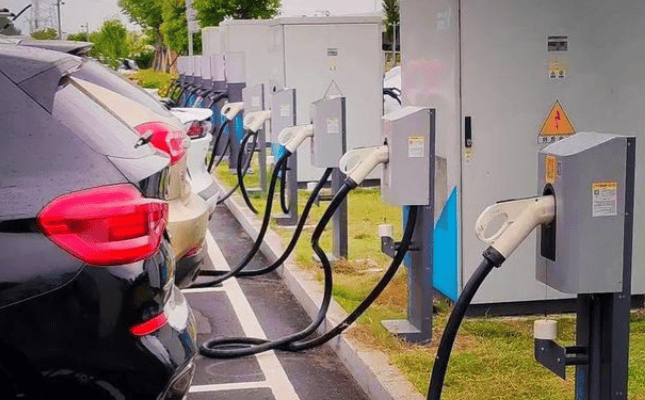

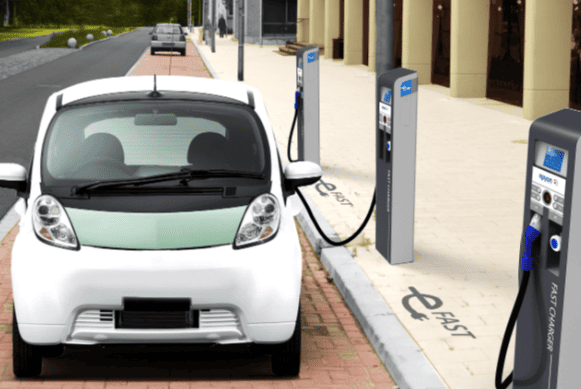

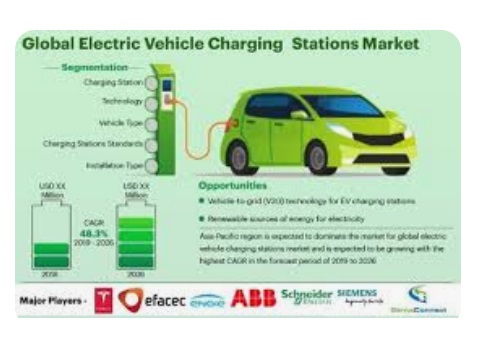

These tax breaks are not the only factor contributing to the EV charging station industry’s profitability; a significant and ongoing shift in the automotive sector toward electrification is also a major factor. Accessible charging infrastructure is becoming increasingly necessary as the number of electric vehicles on the road worldwide rises exponentially every year. There is a significant opportunity for companies and entrepreneurs because the demand for public charging ports is far greater than the supply at this time. Like investing in gas stations during the rise of the internal combustion engine, the business model basically entails constructing the infrastructure that will power transportation in the future. Strategic placement, effective operations, and utilizing a variety of revenue sources are the keys to profitability.

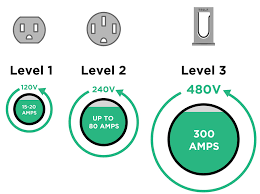

The financial viability of these projects is significantly increased by government policies, especially tax credits and grants. Installing EV charging stations can be expensive up front. It covers the cost of electrical components, construction, permits, the charging hardware itself (Level 2 AC chargers or DC fast chargers), and possibly expensive upgrades to the local electrical grid connection. A significant amount of these upfront capital expenses are directly offset by the tax credit, increasing return on investment and reducing payback time. A tax credit of up to $100,000 can determine whether a project is financially feasible for a large-scale commercial installation. These incentives are designed to de-risk the investment and encourage rapid deployment of chargers, especially in areas that are currently underserved.

A charging station’s revenue model encompasses more than just charging for electricity. The sale of electricity, or kilowatt-hours (kWh), to EV drivers is the most direct source of revenue. A markup over their own electricity costs can be included in the price per kWh that operators set. As an alternative, some stations charge based on the charging time, especially for DC fast chargers. Additionally, a lot of station operators use membership or subscription models, which provide loyal customers with discounted rates in exchange for a monthly fee. This generates a steady stream of income. Furthermore, putting charging stations there can increase foot traffic significantly. A shopping mall, restaurant, or retail store that installs chargers can monetize this indirectly through increased customer dwell time and spending. An EV driver who is charging their vehicle for 20 to 30 minutes is highly likely to spend money at adjacent businesses, making the charging station a valuable amenity that drives overall commercial activity.

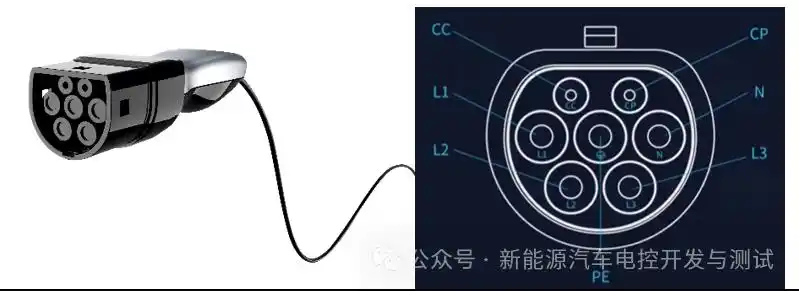

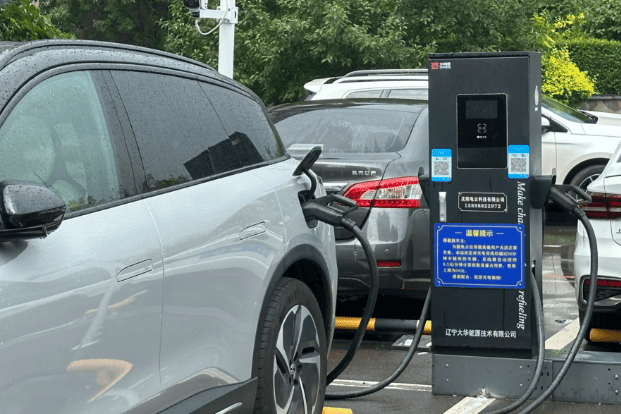

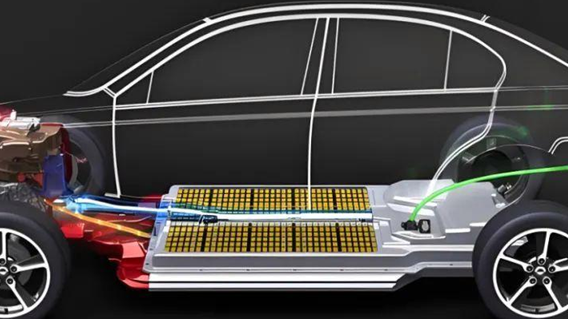

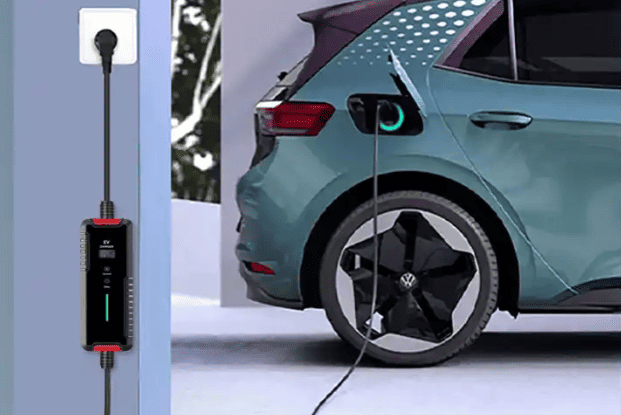

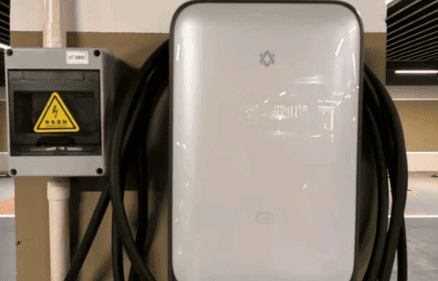

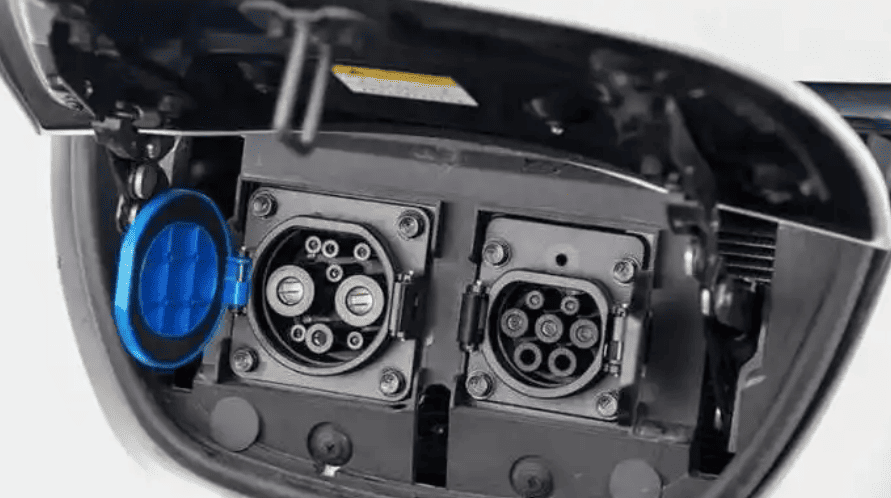

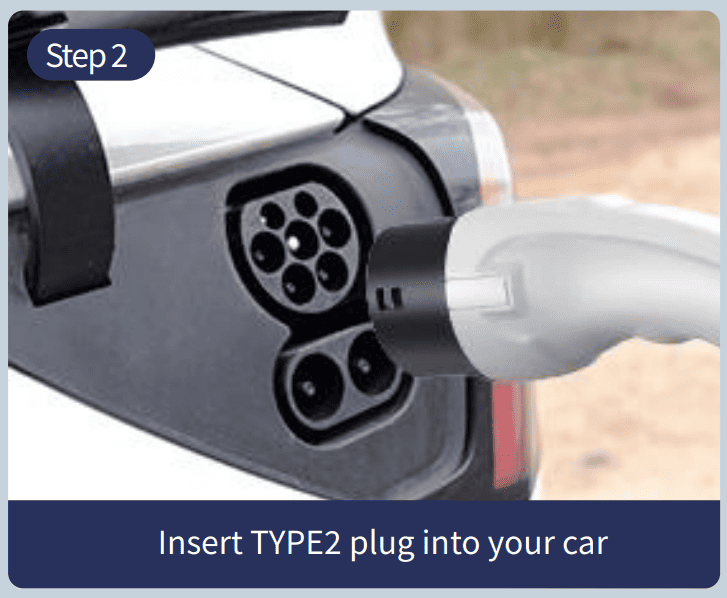

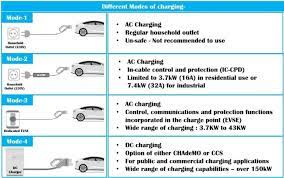

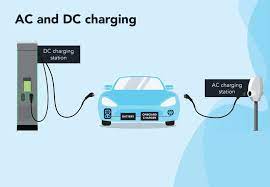

However, strategic planning and careful cost analysis are necessary to achieve profitability. One significant cost factor is the type of charger that is installed. Although level 2 chargers are less costly to buy and install, they charge more slowly, which makes them appropriate for locations like shopping malls, offices, and apartments where cars will be parked for several hours. DC fast chargers need a far more powerful electrical connection and are far more costly, frequently costing tens of thousands of dollars per unit. But since they can charge a car in less than an hour, they are crucial for long-distance travel on highways and corridors. Their capacity to serve more clients each day and produce income more rapidly justifies their higher cost.Operational costs also include network fees (if the station is connected to a roaming platform), regular maintenance, payment processing fees, and software management subscriptions.

Perhaps the most significant factor influencing a charging station’s success and profitability is its strategic location. Customers in constant need of a quick charge to continue their journey will frequent a station situated on a major highway between two cities. A station in a remote location with minimal EV traffic, on the other hand, might remain unoccupied. A different opportunity exists in urban areas, where there is a high demand for public Level 2 chargers in residential neighborhoods because many apartment dwellers are unable to install home chargers. Finding the most lucrative market gaps requires using information on EV registrations, traffic trends, and the locations of current chargers.

Looking at policies in other countries reinforces the global trend of government support. For instance, in China, while there is no nationwide tax credit system identical to the U.S., local governments provide substantial support. Cities like Chengdu and Luzhou offer a 50% reduction in urban land use tax for charging station sites. Furthermore, direct financial subsidies are common, where local governments provide a certain percentage of the investment cost back to the operator. On the value-added tax (VAT) front, companies can deduct the input tax paid on equipment and materials related to the construction and operation of charging stations. In Malaysia, the government is offering personal income tax relief of up to 2,500 Malaysian Ringgit for expenses related to the installation, rental, or purchase of EV charging stations between 2023 and 2032, which stimulates private investment in home and commercial chargers.

In conclusion, the EV charging station business is undoubtedly profitable, but it is not a simple get-rich-quick scheme. This infrastructure investment necessitates thorough market research, strategic planning, and a thorough comprehension of the associated expenses and income sources. A strong financial catalyst that lowers the barrier to entry and enhances the economics of these projects is provided by the generous tax credits and incentives, especially those included in the U.S. Inflation Reduction Act. The need for charging stations will only increase as the global wave of electric vehicle adoption keeps growing. Building and running EV charging stations is an ambitious and potentially very lucrative project that supports the global shift to sustainable energy for companies and investors who carry out careful due diligence, pick the best sites, and run their operations effectively.