How to open an electric car charging station in india

How to Open an Electric Car Charging Station in India: A Comprehensive Guide

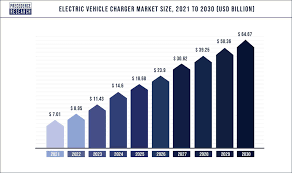

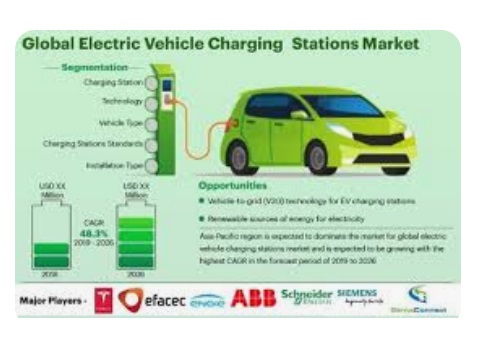

Opening an electric vehicle (EV) charging station in India requires careful attention to government policy, technical standards, infrastructure development, and sustainable operational models. Success hinges on navigating the supportive yet complex regulatory framework, ensuring compatibility with diverse vehicle types, overcoming significant infrastructure hurdles, and designing a financially viable business approach tailored to the unique characteristics of the growing Indian EV market.

Understanding and Leveraging Policy Support is fundamental.

With important initiatives, the Indian government is aggressively promoting the adoption of EVs. With the ambitious goal of setting up 72,000 public charging stations across the country, the Ministry of Heavy Industries’ flagship “PM E-Drive” program allots a sizeable budget of 2 billion euros, or roughly ₹18,000 crores. Deploying these stations along important National Highway corridors is a key strategic focus to reduce range anxiety for inter-city travel. Most importantly, this program requires all charging stations to connect to a single, official application. This app is central to the user experience, enabling essential functions like real-time station location and availability checks, advance booking slots, and seamless online payment processing. This policy framework provides both financial incentives through subsidies and a clear operational directive, setting the foundation for a connected charging network. Entrepreneurs must stay updated on specific state-level EV policies and subsidy schemes, which can offer additional support like land allocation or reduced electricity tariffs.

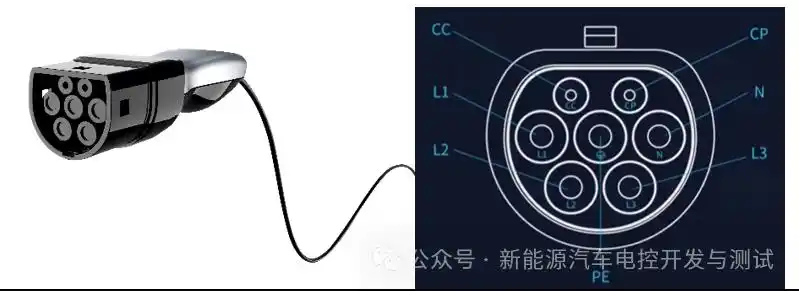

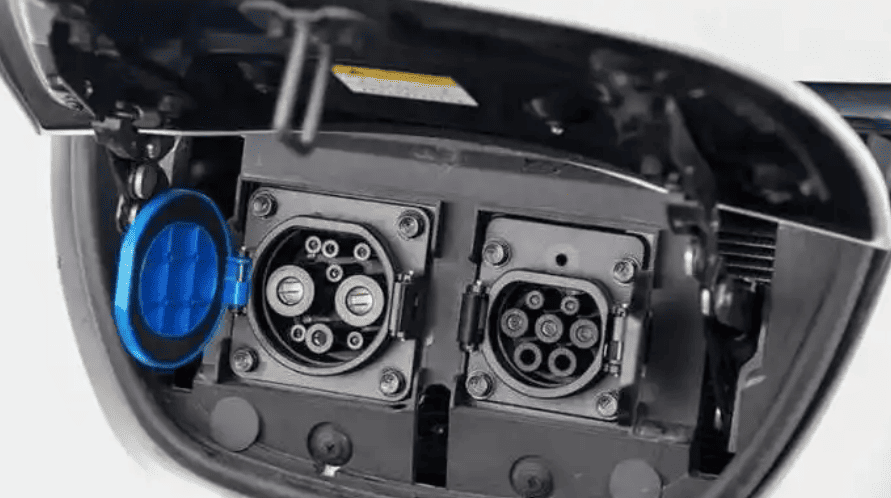

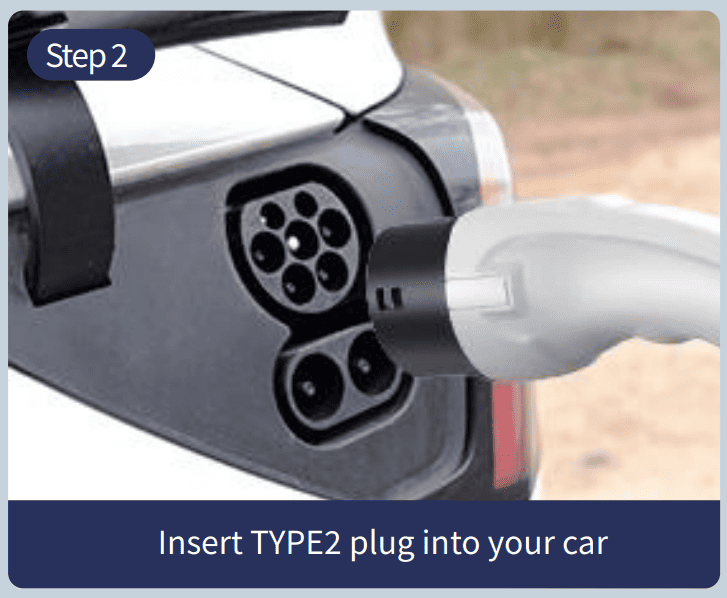

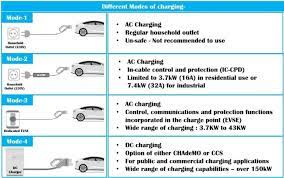

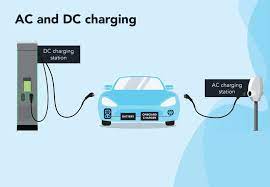

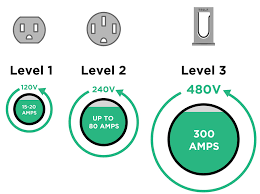

Navigating Technical Standards is critical for interoperability and customer satisfaction.

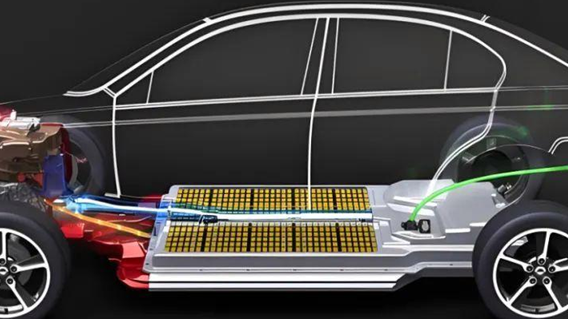

In order to accommodate vehicles from different manufacturers that adhere to different international standards, India currently requires public charging stations to install at least two different types of charging connectors. Usually, this entails offering connectors that are compatible with widely used protocols, such as the European CCS2 (which is soon to become the standard for the majority of new international and Indian four-wheelers, including the Tata Nexon EV) and the Japanese CHAdeMO (which is common for early EVs like the Nissan Leaf). Support for the Chinese GB/T standard, which is utilized by some models like the MG ZS EV, and the Indian Bharat DC-001 standard, which is common for electric three-wheelers and some older cars, is also frequently required.The challenge lies in the absence of a single, nationwide mandated standard. While CCS2 is gaining strong traction for new four-wheelers, the market remains fragmented, especially considering the dominance of two and three-wheelers. Stations must, therefore, offer a mix of connectors (DC fast chargers like CCS2/CHAdeMO and slower AC chargers like Type 2 AC or Bharat AC-001) to serve the broadest range of customers effectively. Future-proofing investments by choosing chargers capable of software updates to support emerging standards is highly advisable.

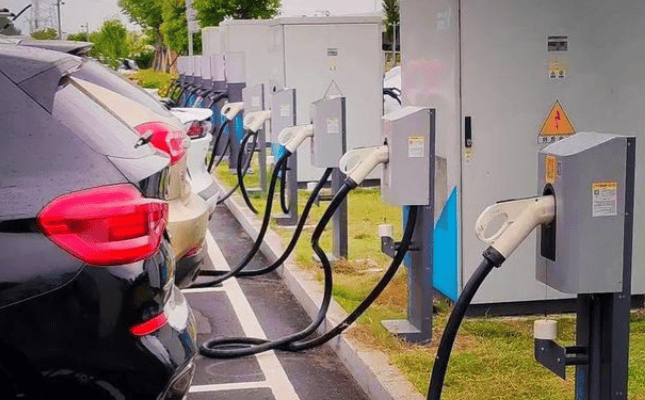

Overcoming Infrastructure Development Challenges demands significant planning and investment.

The first major hurdle is Land Acquisition. Securing suitable land, especially in high-demand urban centers, involves complex coordination with local planning authorities and navigating zoning regulations, potentially requiring land use change approvals. Costs can be prohibitively high in prime locations, making partnerships with existing landholders (like fuel stations, malls, or hotels) strategically advantageous. The second critical aspect is Power Supply and Grid Connectivity. Establishing a charging station, particularly one featuring fast or ultra-fast DC chargers, requires a substantial and stable high-capacity electrical connection. This necessitates close collaboration with the local electricity distribution company (DISCOM). In older parts of cities, existing grid infrastructure may be inadequate, demanding significant and costly upgrades, including potentially dedicated transformers. The stability of power supply can also be seasonally variable, especially during peak summer months, impacting operational reliability. Investing in backup power solutions like diesel generators or battery storage might be essential, albeit adding to capital costs. Strategic Site Selection is paramount for commercial viability. Prioritizing locations with high EV traffic density significantly increases utilization rates. Ideal spots include existing petrol/diesel fuel stations (leveraging existing vehicle traffic), major transportation hubs (railway stations, airports, bus depots), large commercial centers (shopping malls, multiplexes), office complexes, and densely populated residential areas. Crucially, aligning with the government’s highway corridor focus by setting up stations along National Highways (NH) and State Highways (SH), preferably near amenities like restaurants and rest areas, taps into the critical need for inter-city charging.

Developing a Sustainable Operational Model is key to profitability.

Cooperation can maximize resources and reduce risks. Demand aggregation, possible access to government land, and cooperative development of the unified application ecosystem required by the PM E-Drive scheme are all benefits of partnering with well-established Public Sector Undertakings (PSUs), such as Bharat Heavy Electricals Limited (BHEL). Lowering entry barriers can also be achieved by investigating novel service models. Companies such as Hopcharge, for example, provide mobile charging services (vans with big batteries), delivering charging right to the customer’s location. This model eliminates the need for expensive real estate and grid upgrades initially, allowing operators to test markets and build a customer base before investing in fixed infrastructure. The core revenue stream is the Charging Service Fee, regulated by state electricity regulatory commissions (SERCs). Typically, this fee is capped at an average of 15% above the prevailing commercial electricity tariff in the area. Operators must carefully model costs (electricity, land lease/ownership, maintenance, staff, network fees, software subscriptions) against this capped revenue to ensure profitability. Diversifying income through advertising, partnerships with co-located businesses (e.g., cafes), or offering premium membership plans can enhance revenue streams.

Crucial Market Considerations and Regulatory Compliance must be addressed.

A defining feature of the Indian EV market is the overwhelming dominance of electric two-wheelers (e-scooters, e-bikes) and three-wheelers (e-rickshaws). While sales of electric four-wheelers (cars) are growing rapidly, they constituted only about 4% of total EV sales in 2022. Charging infrastructure planning must account for this. Stations should incorporate sufficient AC chargers (slower but cheaper) suitable for 2W/3Ws, alongside DC fast chargers for cars and potential future demand. Locations near public transit hubs, markets, and dense residential areas catering to 2W/3W users are vital. Navigating the Regulatory Landscape involves several steps. Fortunately, the Electricity Act 2003 exempts public EV charging stations from needing a separate electricity distribution license. However, obtaining a No Objection Certificate (NOC) from the local municipal authority is mandatory. Compliance with the Central Electricity Authority (CEA)’s technical and safety guidelines for charging infrastructure is non-negotiable. Fire safety clearances and building permits are also essential. All charging equipment deployed must carry certification from the Bureau of Indian Standards (BIS), ensuring safety and quality.

Following a Structured Implementation Process ensures a smooth setup:

- Conduct Thorough Market Research and Site Analysis: Don’t limit yourself to EV registration numbers. Examine competitor locations, determine high-traffic routes for both personal and commercial EVs (particularly 2W/3W), and analyze local commuting patterns. Consider visibility, accessibility, traffic flow, proximity to facilities, land cost and availability, and—most importantly—the cost and viability of obtaining a sufficient grid power connection when evaluating possible locations. Targets include commercial areas (restaurants, shopping malls), residential/commercial complexes (offices, apartments), and hospitality venues (hotels).

- Finalize Your Business Model: Decide between a fully public model (open to all EV users), a dedicated fleet charging model (serving taxi companies or logistics fleets), or a partnership-based model (installing chargers on property owned by malls, hotels, or real estate developers, sharing space/revenue). The hybrid approach (public access combined with fleet contracts) often maximizes utilization.

- Secure Necessary Permissions and Approvals: While no electricity license is needed, proactively engage with the local municipal corporation for the essential NOC. Simultaneously, apply for the required electrical connection from the local DISCOM – this often involves requesting a dedicated high-tension (HT) connection or significant load enhancement for commercial supply. Obtain clear fire safety certificates and building permits. Ensure all planned charging equipment has valid BIS certification.

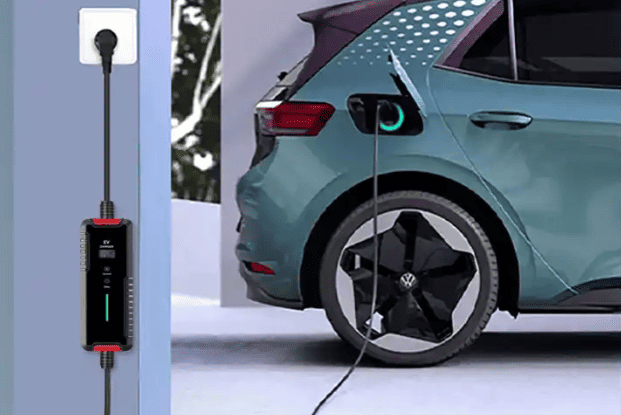

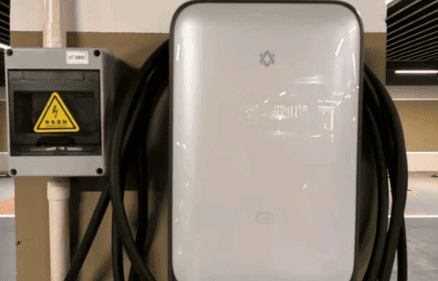

- Procure Robust Infrastructure and Technology: Select charging hardware based on your target market (mix of AC chargers for 2W/3W/cars, DC fast chargers for cars/taxis) and site power capacity. Partner with reputable manufacturers known for reliability and service support. Procure all ancillary equipment: transformers (if needed), switchgear, cabling, metering systems, safety gear (earthing, surge protection), and physical security/canopy structures. Crucially, select a sophisticated Charging Management System (CMS) software partner (like YoCharge, Statiq, or others). A good CMS handles user authentication (via RFID/app), remote monitoring, dynamic pricing, payment gateway integration, energy management, fault alerts, and detailed reporting – essential for efficient operations.

- Execute Professional Construction and Installation: Hire qualified electrical contractors with specific experience in EV charging installations. Ensure construction adheres strictly to CEA safety guidelines, local building codes, and manufacturer specifications. This encompasses civil works (cable trenching, foundation laying), electrical works (cable laying, panel installations), mounting and commissioning chargers, setting up networking/communication links, and installing clear signage and user instructions.

- Launch with Effective Promotion and Marketing:Raise awareness! Put a prominent listing for your station on your own website or social media accounts, as well as on popular navigation apps like Google Maps and MapmyIndia and EV-specific apps like PlugShare, Tata Power EZ Charge, and the government’s unified app. Provide loyalty plans or launch promotions. Create cross-promotional alliances with local companies. Directly address fleet operators. Stress the benefits of location, dependability, and ease of use.

Through careful consideration of these interrelated factors—technical compatibility, infrastructure realities, operational viability, policy alignment, and market nuances—entrepreneurs can successfully set up and run lucrative EV charging stations, making a substantial contribution to India’s e-mobility revolution. Although the journey necessitates meticulous preparation and financial outlay, there is significant potential in this quickly expanding market.