How much does an ev charging station cost?

How much does an ev charging station cost? Depending on factors like power capacity, location, regulations, and target market, the price of an EV charging station can range from $500 for a basic home unit to over $500,000 for a commercial ultra-fast hub. Designing competitive products and seizing international opportunities as a global manufacturer requires an understanding of these factors. We break down the regional subtleties and cost layers influencing this ever-changing industry below.

Breaking Down Charging Station Costs

1. Hardware Costs: The Foundation

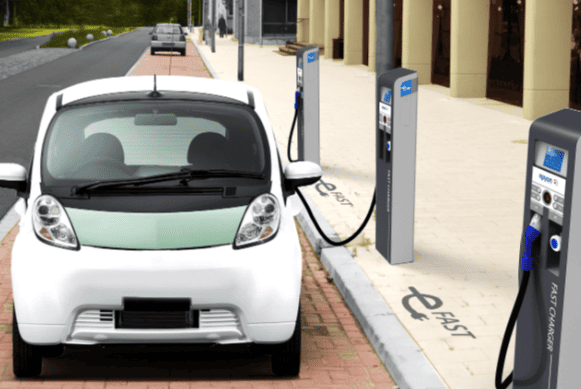

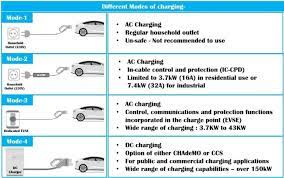

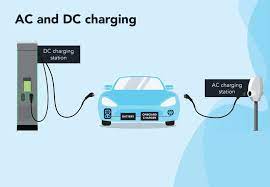

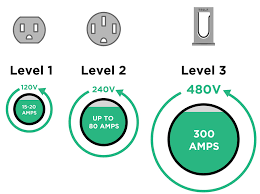

- Level 1/Portable Chargers (1–3 kW): Priced at $500–$1,500, these plug into standard household outlets but add only 5–12 km of range per hour. Ideal for emergency use or low-mileage drivers.

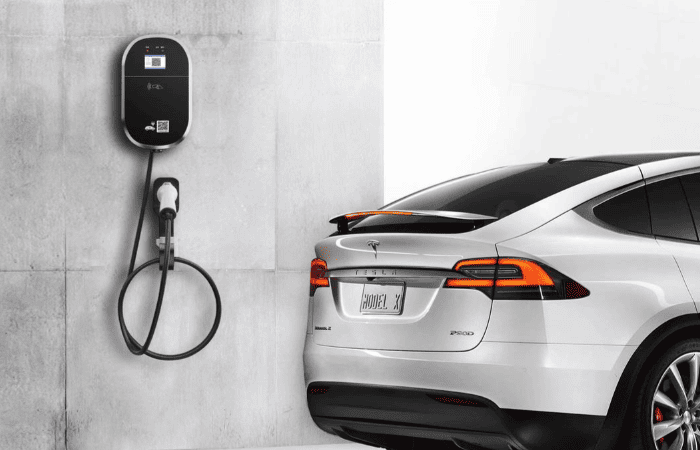

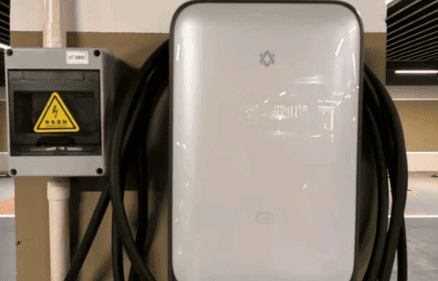

- Level 2/AC Chargers (7–22 kW): At $500–$5,000, they dominate homes and workplaces, delivering 30–80 km/hour. Commercial-grade versions (e.g., 22 kW three-phase) cost up to $7,000 with Wi-Fi/solar integration.

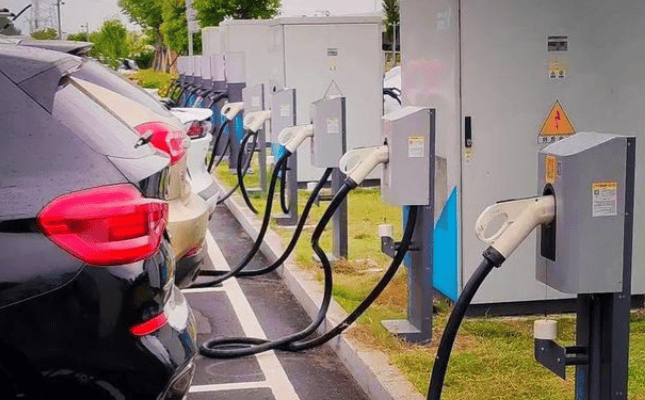

- DC Fast Chargers (50–350 kW): The most expensive tier:

- 50–120 kW units: $20,000–$50,000

- 150–350 kW ultra-fast units: $75,000–$150,000

High costs stem from complex power modules and cooling systems.

2. Installation & Infrastructure: Hidden Expenses

- Electrical Upgrades: Commercial sites often require grid upgrades:

- Transformers (630kVA): $15,000–$50,000

- High-voltage cabling: $5,000–$20,000 per station.

- Civil Engineering: Trenching, concrete pads, and canopy setups add $10,000–$100,000, especially in urban areas with complex permitting.

- Smart Systems: Cloud platforms, payment gateways, and load-balancing software incur $1,000–$10,000 per unit.

3. Operational Costs: The Long Game

- Maintenance: Annual upkeep averages 5–10% of hardware costs (e.g., $2,500/year for a $50,000 DC charger).

- Electricity: Commercial rates vary wildly:

- Germany: $0.30–$0.55/kWh

- Texas: $0.05–$0.12/kWh.

- Land/Access: Urban leases cost $10,000–$50,000/year per parking spot in cities like Shanghai or New York.

Regional Market Analysis: Costs & Compliance

North America: Scalability Meets Regulation

- Hardware: Level 2 units dominate homes ($1,200–$5,000); DC fast chargers require UL certification (+15% cost).

- Infrastructure: Rural sites save 40% on land but pay 30% more for grid connections. Tesla’s NACS standard now mandates adapter integration.

- Policy: Federal tax credits cover 30% of costs (up to $100,000 per site), but local permits delay projects 6–12 months.

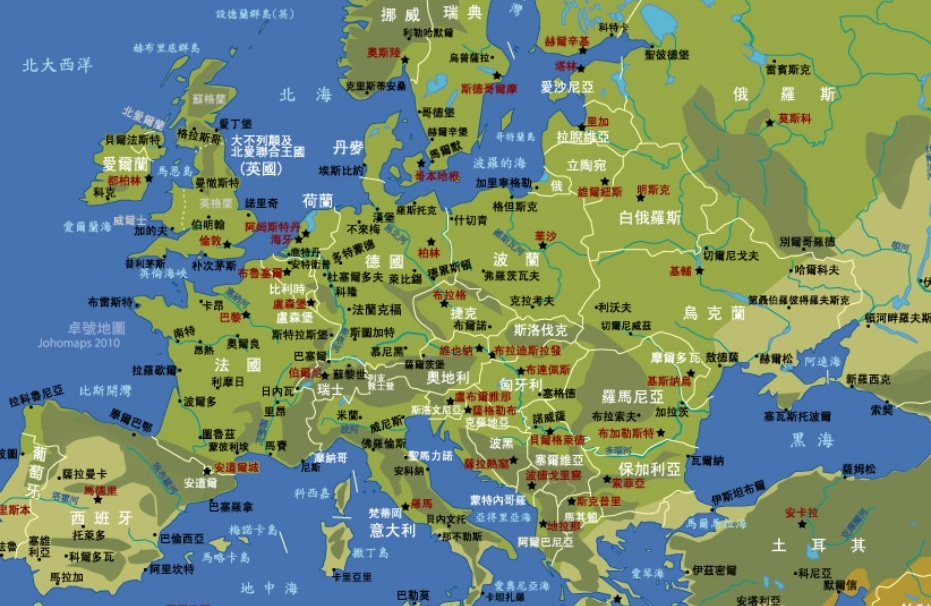

European Union: Green Tech Premium

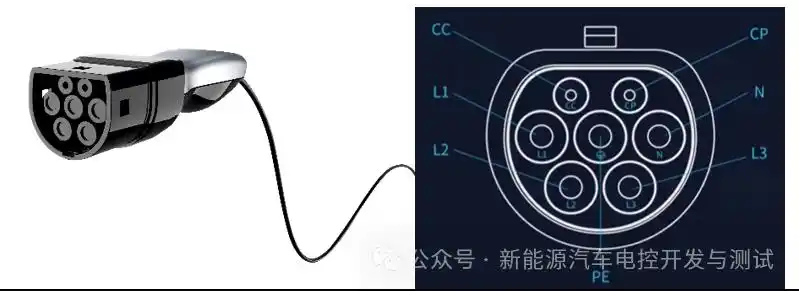

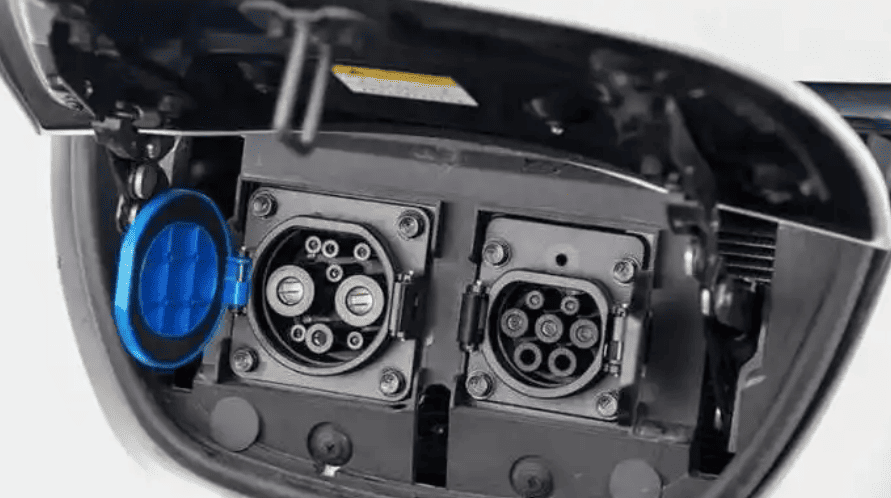

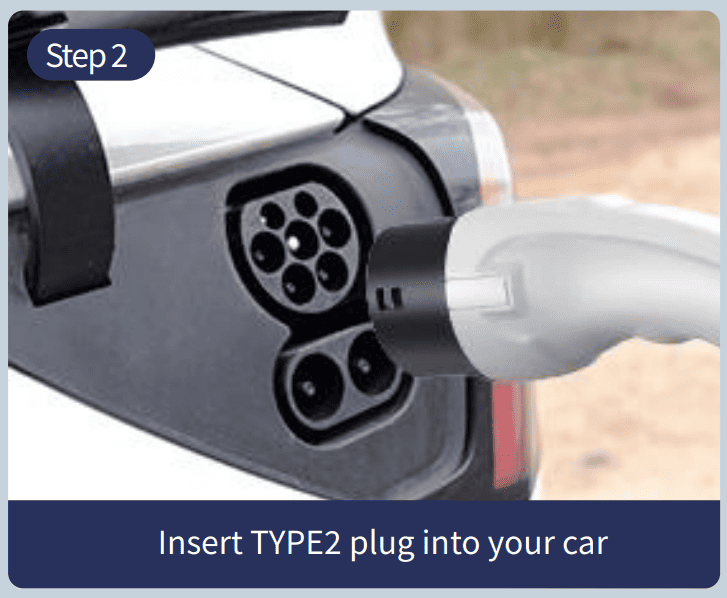

- Hardware: Type 2 connectors and 22 kW three-phase units are mandatory. V2G (vehicle-to-grid) compatibility adds 20% to costs.

- Compliance: CE marking and OCPP 1.6 protocol adherence increase R&D spend by 10–15%.

- Incentives: Germany subsidizes 30% of installation fees; France waives taxes for solar-powered stations.

Asia-Pacific: Compact & High-Voltage Focus

- Japan: CHAdeMO support and 100V/200V dual-voltage design are essential. Space-saving units (e.g., wall-mounted DC) command 25% premiums.

- Australia: IP65-rated, UV-resistant enclosures (+12% cost) are non-negotiable for outdoor use. Solar-battery hybrids cut operational costs by 40%.

Emerging Markets: Cost-Sensitive Innovation

- Southeast Asia: $10,000–$20,000 DC units dominate highways. Malaysia’s DC Handal charges $0.25/kWh (vs. $0.40–$0.60 in urban centers).

- India: Government mandates CCS-2; 30-kW DC chargers at $15,000 target affordability.

Optimizing Costs: Strategic Approaches for Manufacturers

1. Localized Production & Sourcing

- Regional Assembly: Building plants in the EU/US avoids 20–30% tariffs. Example: Tesla’s Shanghai factory cut Model 3 costs by 50%.

- Modular Design: Swappable power cabinets (e.g., 50 kW → 150 kW upgrades) reduce replacement costs by 60%.

2. Policy-Driven Partnerships

- Subsidies: Bundle products with subsidy applications (e.g., California’s $100,000 site grants).

- Utility Collaborations: Joint ventures with grid operators (e.g., Enel X) slash electricity markups.

3. Technology & Scalability

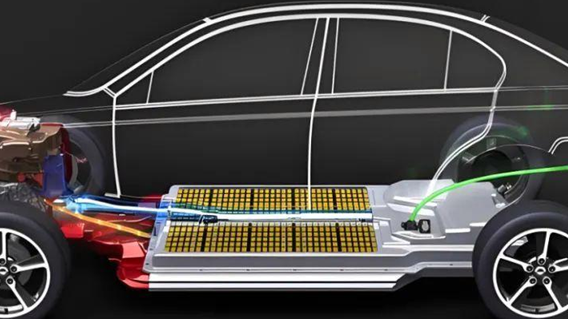

- Bidirectional Charging: V2G-ready units sell at 25% premiums but enable energy resale (e.g., UK’s Octopus Energy pays $0.19/kWh for EV power).

- AI Optimization: Predictive maintenance algorithms cut downtime by 30% and extend hardware life.

Future Cost Trends: What Investors Should Watch

- Battery-Buffered Stations: Stores off-peak power for high-demand sales, boosting margins 15–20% by 2027.

- Ultra-Fast Charging: 350 kW units will drop to $50,000 by 2026 as silicon carbide semiconductors mature.

- Regulatory Shifts: EU’s 2025 price cap ($0.70/kWh) and China’s GB/T 2023 standard will reshape pricing.

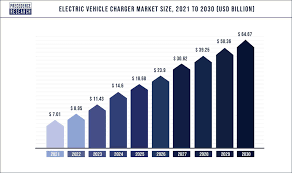

Conclusion: Strategic Investment Pays Off

EV charging station costs are plummeting—DC fast charger prices fell 40% since 2022—but regionalization is key. Manufacturers prioritizing local compliance (UL/CE/SAA), modularity, and policy leverage will lead this $200 billion market. For investors, the sweet spot lies in 120–150 kW DC stations ($100,000–$200,000 per site), which achieve payback in 3–5 years via rising EV adoption and smart energy arbitrage.

Table: Cost-Saving Strategies by Region

| Region | Hardware Focus | Policy Hack | ROR Timeline |

|---|---|---|---|

| North America | NACS + UL-certified DC | Leverage IRA tax credits | 2–4 years |

| European Union | Type 2 + V2G | Bundle with solar subsidies | 3–5 years |

| Asia-Pacific | CHAdeMO/IP67 DC | Partner with highway operators | 4–6 years |

“The future isn’t just about charging cars; it’s about integrating them into the grid. Manufacturers who enable this will win.” — Global EV Council, 2025 Report