How much does a commercial ev charging station cost?

How much does a commercial ev charging station cost?

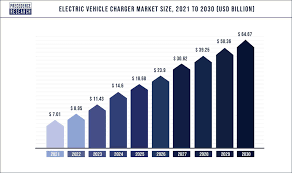

The total cost of a commercial EV charging station typically ranges from $30,000 to over $500,000, depending on its scale, technology, location, and power capacity—encompassing equipment, installation, infrastructure, land, and ongoing operational expenses. Unlike residential chargers, commercial stations require high-power hardware, grid upgrades, and compliance with stringent safety standards, making them a significant investment. Below, we dissect every cost layer and regional variable shaping this emerging infrastructure.

Infrastructure and Hardware Costs: The Foundation

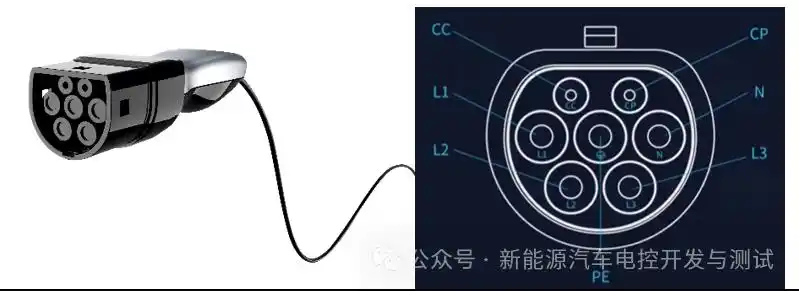

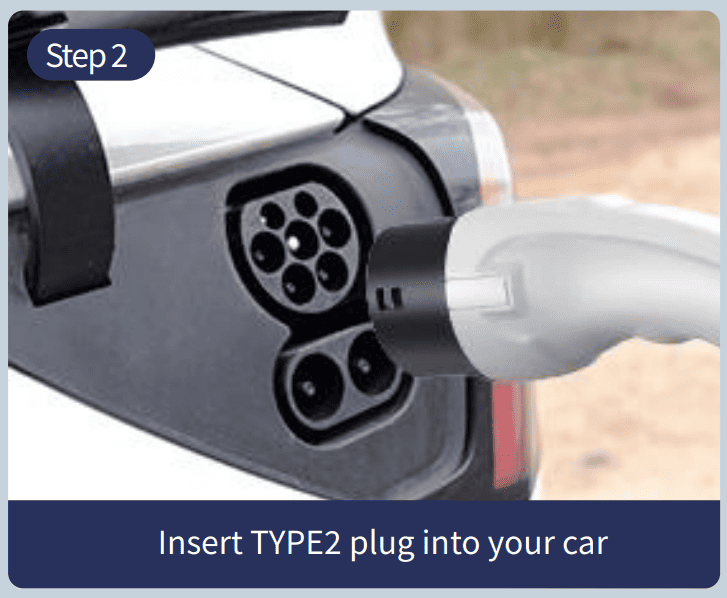

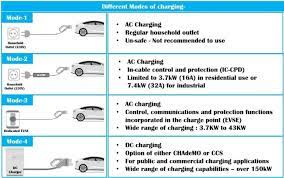

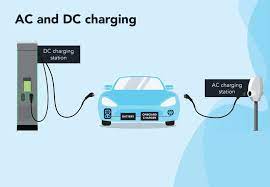

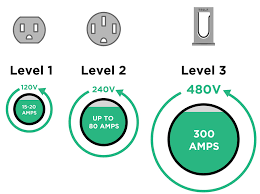

Strong hardware designed for public use is required for commercial charging stations. Parking lots and hotels frequently have AC chargers (Level 2), which range in price from $400 to $900 per unit (e.g., 7–22 kW). Commercial models from brands like Gongniu cost about 260 RMB (1,873). However, high-traffic applications are limited by their slow charging speed (40–50 km/h).

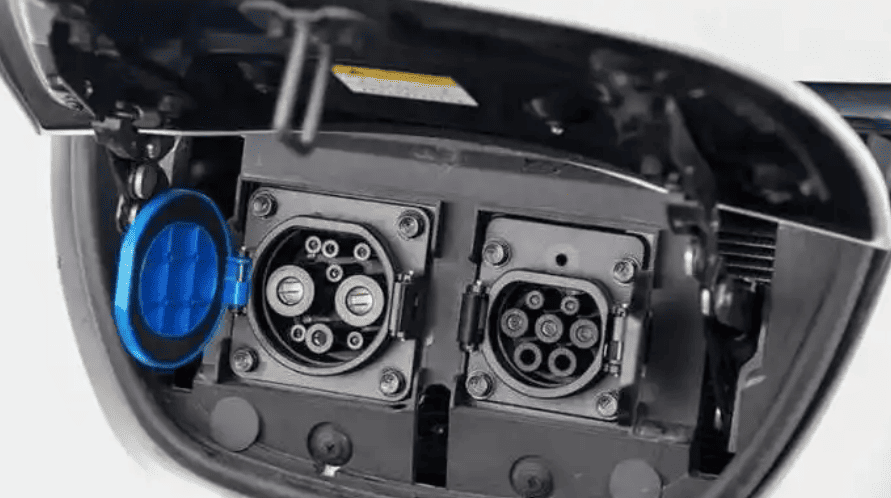

Highways and urban centers are dominated by DC fast chargers (50–350 kW). Ultra-rapid 480 kW chargers cost more than $28,000 per unit, while a 120 kW dual-port unit costs about $5,100 (36,900 RMB). Relays and liquid-cooled cables are examples of high-voltage components that raise base prices by 20% to 30%. The hardware alone costs about $2.8 million (20 million RMB) of the $3.2 million (23 million RMB) budget for large-scale deployments, such as the project in Tongchuan New District to install 1,700 chargers (1,000 fast and 700 ultra-fast).

Support infrastructure often doubles initial outlays:

- Transformers and grid connections: A 630 kVA transformer costs $28,000–$70,000 (200,000–500,000 RMB). Projects like Guangzhou’s Huadu Supercharge Station spent ~$24,500 (175,000 RMB) on substations.

- Civil engineering: Trenching, paving, and electrical conduits add $7,000–$140,000 (50,000–1,000,000 RMB), especially in retrofitted sites like Guangzhou’s JinShaZhou station, which repurposed 26 parking spaces.

Installation and Grid Upgrades: Hidden Expenses

Commercial stations require industrial-grade electrical systems. For sites lacking three-phase power, grid upgrades cost $14,000–$140,000 (100,000–1,000,000 RMB). Permitting and labor further inflate expenses:

- Licensing: Electricians need utility certification (e.g., China’s Class III Power Facility License), adding ~$2,800 (20,000 RMB) in compliance fees.

- Labor: Complex wiring for 350 kW chargers demands specialized crews, costing $140–$700 (1,000–5,000 RMB) per meter of cable. The JinShaZhou project allocated $360,000 (2.6 million RMB) for a 70-day installation.

Land and Site Development: Location Dictates Price

Urban stations face steep leasing fees. A central-city parking spot leases for $420–$550/year (3,000–4,000 RMB) in China. For a 20-port station, annual rent can hit $11,000 (80,000 RMB). Rural areas offer lower rents but higher grid-access costs—remote sites may need $70,000 (500,000 RMB) for power-line extensions.

Zoning requirements also impact budgets:

- Fire systems (e.g., smoke detectors, 20L/s hydrants) add ~$7,000 (50,000 RMB).

- Safety buffers between chargers and buildings increase land footprints by 15–20%.

Government Subsidies: Offsetting Capital Costs

National and regional incentives significantly reduce upfront investment. China’s 2025 policy offers:

- DC charger subsidies: Up to $110/kW (800 RMB/kW), with ultra-rapid chargers (≥480 kW) qualifying for $165/kW (1,200 RMB/kW).

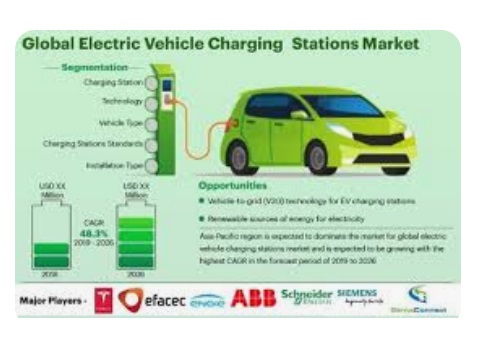

- Smart-tech bonuses: Stations with V2G (vehicle-to-grid) or solar integration earn extra $28/kW (200 RMB/kW) in Jilin Province.

- Rural premiums: Townships receive 20% higher subsidies than cities—e.g., $41/kW (300 RMB/kW) for ≥60 kW chargers in Anhui.

However, subsidies mandate strict conditions:

- Compliance: Chargers must connect to provincial/national monitoring platforms (e.g., Sichuan’s “Chuanyichong” APP).

- Power minimums: Highway chargers require ≥60 kW ports, while “smart communities” need ≥7 kW.

Operational Costs: Beyond Installation

Electricity dominates ongoing expenses. Commercial rates vary wildly:

- Peak pricing: Shanghai charges up to $0.32/kWh (2.32 RMB/kWh) midday.

- Off-peak discounts: Operators using national platforms get 50% service-fee waivers from 11 PM–7 AM.

Maintenance consumes 10–15% of annual revenue:

- DC charger repairs cost $700–$2,100 (5,000–15,000 RMB) monthly due to cooling-system failures.

- Software updates and payment-system fees add $2,800–$5,600 (20,000–40,000 RMB) yearly.

Service fees bridge operational gaps. Operators like TeLaiDian charge $0.04–$0.06/kWh (0.27–0.6 RMB/kWh), but local caps apply (e.g., Lu’an limits fees to $0.05/kWh).

Revenue and ROI: Balancing the Equation

Profitability hinges on utilization rates and subsidies. A 120 kW DC charger earning $0.30/kWh (2 RMB/kWh) needs 5–8 daily sessions to break even. However:

- High-traffic sites: Highway stations with 15+ daily users yield 3-year paybacks post-subsidy.

- Smart management: “Load-shifting” using low-tariff night power cuts costs by 30%.

Long-term risks persist:

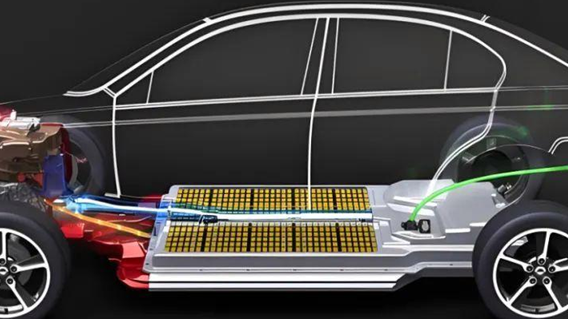

- Tech obsolescence: Non-upgradable chargers may become incompatible with 800V EVs (e.g., Porsche Taycan).

- Subsidy reductions: Post-2025 incentives may shrink, urging operators to lock in agreements now.

Conclusion: Strategic Investment Pays Off

Commercial EV station construction combines operational complexity with high capital costs ($30,000–$500,000+). However, site optimization, tech selection, and targeted subsidies can reduce payback periods to three to five years. Give high-use areas (highways, city centers) priority, take advantage of rural incentives, and switch to modular chargers for upcoming improvements. This infrastructure promises sustainability and long-term profit as governments push for net-zero goals, such as China’s target of 10,000+ ultra-fast chargers by 2027.