How do ev charging stations make money?

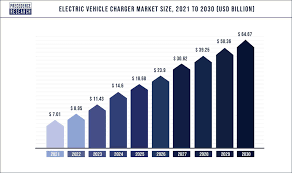

How Do EV Charging Stations Make Money?

EV charging stations generate revenue through a diverse multi-stream business model that goes far beyond simply selling electricity, combining direct charging fees with advertising, value-added services, and strategic partnerships to build a sustainable operation.

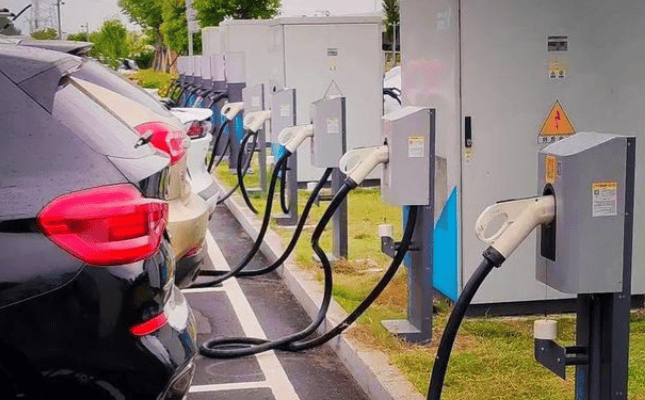

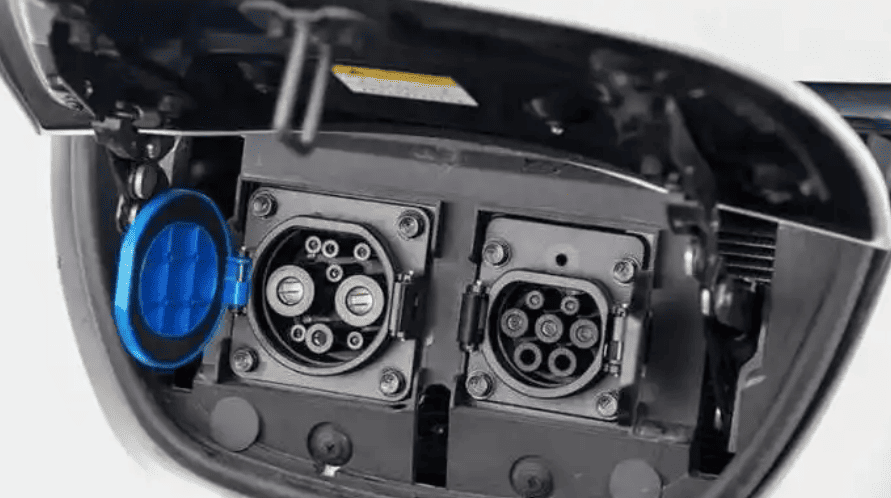

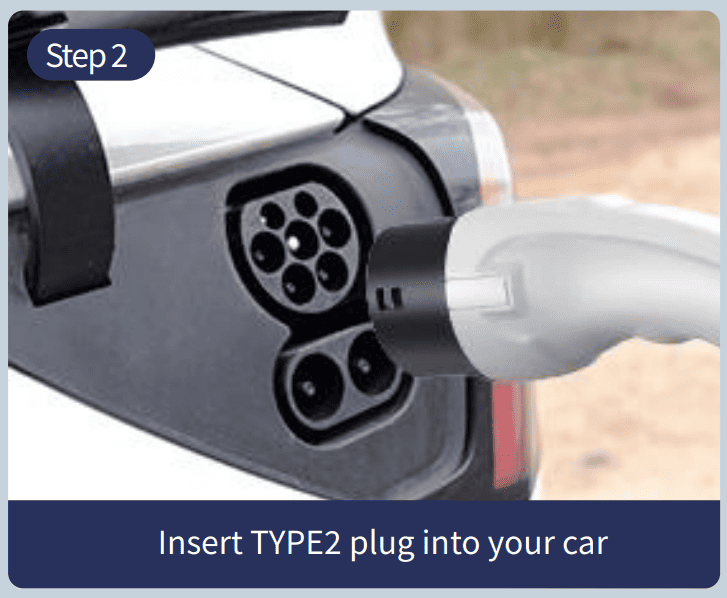

Charging Service Fees: The Primary Revenue Source

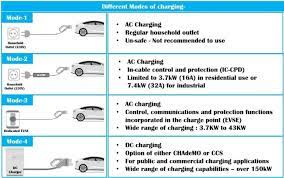

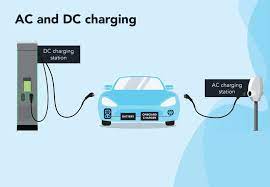

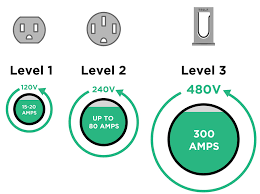

An EV driver’s bill for the kWh of energy consumed when they plug their vehicle into a charger is made up of two components: the actual cost of the electricity itself, which is a pass-through cost from the utility company, and a markup called the “service fee.” This service fee is the station operator’s gross profit on the transaction and covers the costly capital investment in the charger hardware, installation, ongoing maintenance, network connectivity, and customer support. This is the most straightforward and basic way charging stations make money. Rates can vary significantly based on location, charging speed (with DC fast chargers commanding a higher premium than Level 2 chargers), and local market competition. Operators often use dynamic pricing, increasing fees during peak demand hours to manage grid load and maximize revenue.

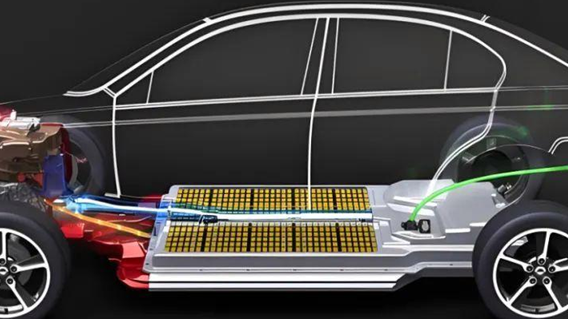

Electricity Cost Arbitrage: Profiting from Price Differences

In order to take advantage of the fluctuations in energy markets, some advanced charging station operators, especially those with on-site energy storage systems, engage in electricity arbitrage. They buy electricity from the grid when wholesale rates are lowest during off-peak hours, store it in large battery systems, and then either use it to power the charger or sell it back to the grid during peak demand periods when electricity prices are at their highest. This buy-low, sell-high strategy requires a significant additional investment in battery technology, but it can create a substantial secondary revenue stream and protect the company from volatile energy prices.

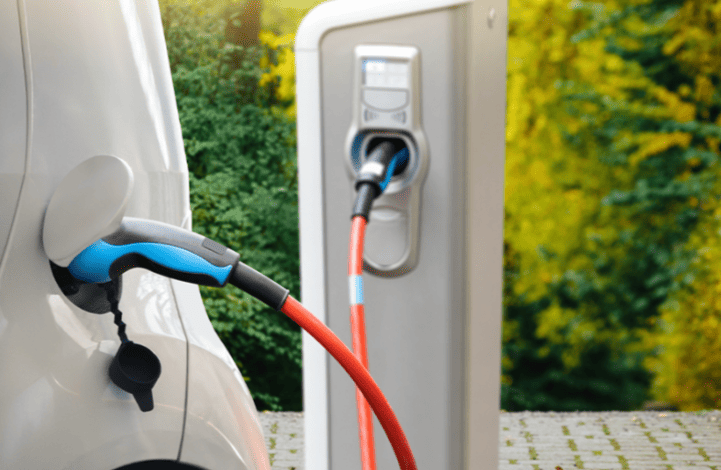

Advertising and Partnership Revenue

The charger units themselves, the surrounding pylons, and the waiting area screens can all host digital or static ads. A station operator can collaborate with brands, local companies, or automotive-related businesses to display targeted ads to a captive audience of drivers who may be parked for 15 to 45 minutes. Additionally, hosting a charger from a particular network, such as Electrify America or EVgo, frequently entails a revenue-sharing agreement with the property owner (e.g., a supermarket or shopping mall), whereby the property owner provides the land and power infrastructure in exchange for a symbiotic partnership.

Value-Added Services to Enhance Customer Spend

To increase their revenue per customer, many charging hubs are transforming into destinations that offer more than just electrons. They integrate valuable amenities that capitalize on the driver’s waiting time. This can include premium lounge areas with comfortable seating and Wi-Fi, automated car wash services, vending machines for snacks and drinks, or even partnerships with adjacent cafés and restaurants that share a portion of their sales with the charging station operator. By creating a pleasant and convenient experience, stations encourage longer stays and higher spending, turning the necessity of waiting into a commercial opportunity.

Subscription and Membership Models

To foster customer loyalty and guarantee a steady stream of recurring revenue, many charging networks offer subscription plans. For a flat monthly fee, members receive benefits such as reduced rates per kWh, reserved parking spots at a charger, or even unlimited charging for a set period. This model provides operators with predictable, upfront income that helps smooth out the fluctuations of pay-as-you-go usage. It also effectively locks users into a specific network, ensuring they will actively seek out that brand’s charger over a competitor’s, thus driving higher utilization rates for their stations.

Government Grants, Incentives, and Carbon Credits

The transition to electric transportation is a key policy goal for many governments worldwide. Consequently, charging station operators can often access significant financial incentives to offset the high costs of installation and operation. These can include direct rebates per charger installed, tax credits, expedited permitting, or favorable utility rates. In some regions, operators can also earn and sell carbon credits by demonstrating the displacement of gasoline-powered miles with clean electricity. These credits can be sold on carbon markets to companies looking to offset their emissions, providing an innovative and impactful revenue stream.

Data Monetization: The Hidden Asset

The data collected by networked chargers is extremely valuable. Each charging session provides a data point containing information on location, time, duration, energy consumption, and vehicle type. When anonymized and aggregated, this data can be packaged and sold to a variety of stakeholders. Urban planners can use it to understand EV adoption patterns, automotive manufacturers can gain insights into real-world battery performance, and utility companies can forecast electricity demand to better manage the grid. This transforms the humble charger into a data-gathering node, creating value long after the charging session is complete.

In conclusion, the profitability of an EV charging station is not reliant on a single source of income but is built on a multifaceted foundation. By blending direct service fees with advertising, strategic site partnerships, value-added amenities, and leveraging government support and valuable data, operators can build a resilient and profitable business model that supports the growing ecosystem of electric vehicles.