How many ev charging stations in the us?

How many ev charging stations in the us?

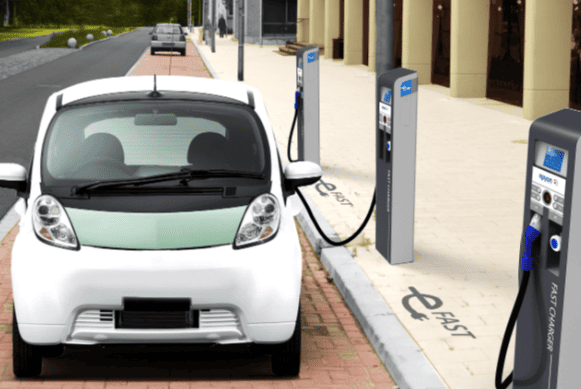

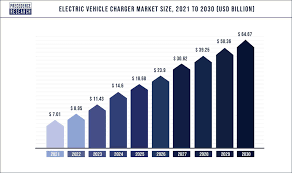

As of Q1 2025, the United States hosts approximately 204,000 public EV charging ports, averaging just one port per 30 electric vehicles—a ratio highlighting significant gaps despite recent growth.

Growth Trends and Infrastructure Composition

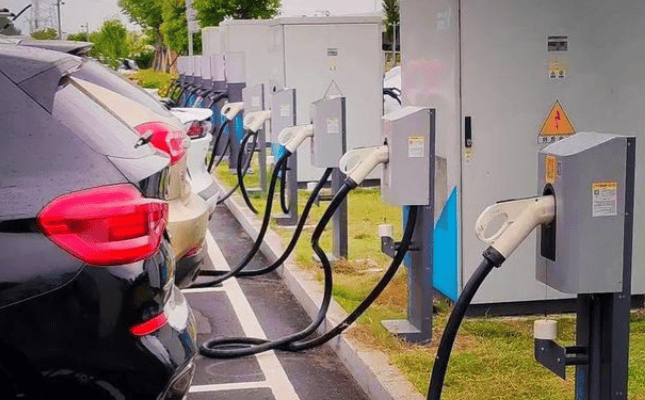

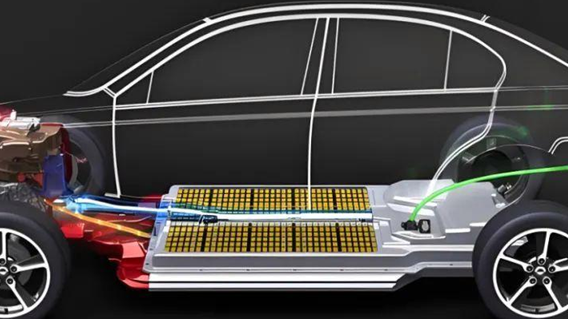

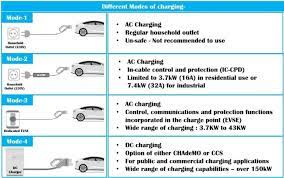

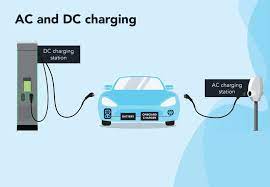

The U.S. public charging network expanded by 11.4% year-over-year in 2024, reaching roughly 183,000 stations. By early 2025, this number grew to 204,000 ports, with 16,700 new high-speed ports added in the first half of 2025 alone (a 23% surge). Charger types are unevenly distributed:

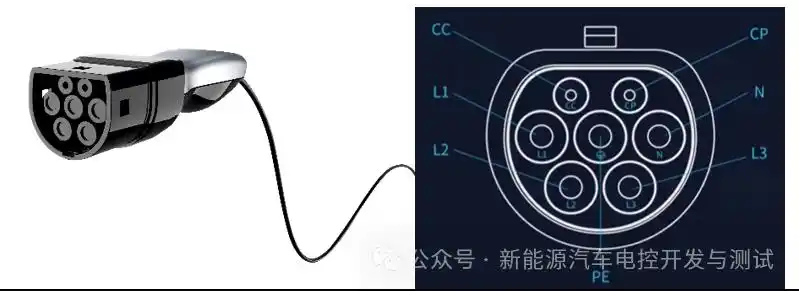

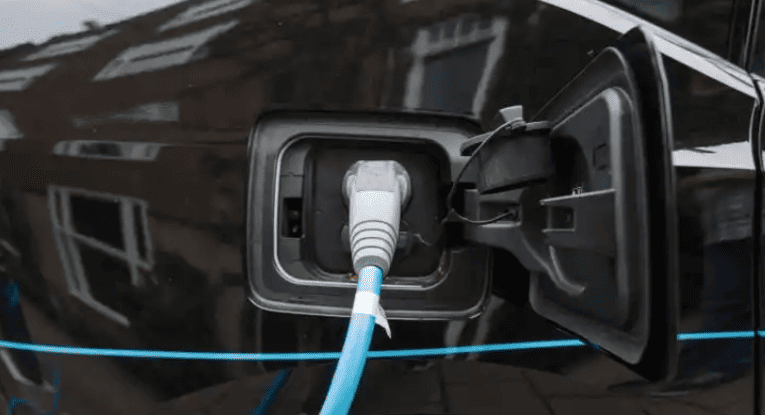

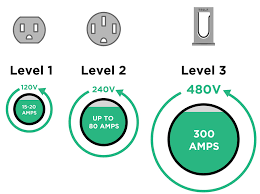

- Level 2 chargers (240V) dominate, exemplified by California’s 162,000 such ports.

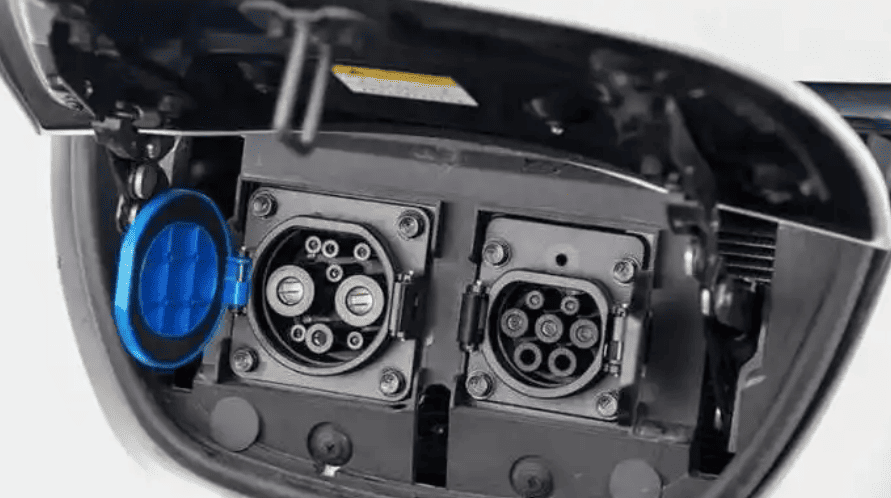

- DC fast chargers remain limited but critical for long-distance travel, with only 17,000 units in California and 59,700 nationwide as of mid-2025.

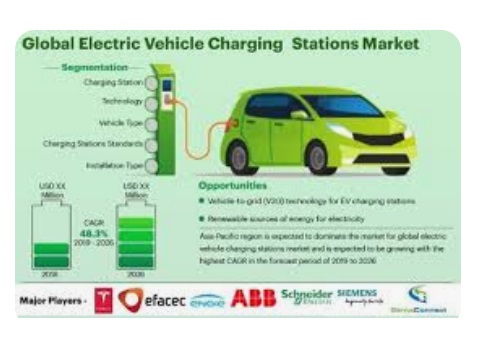

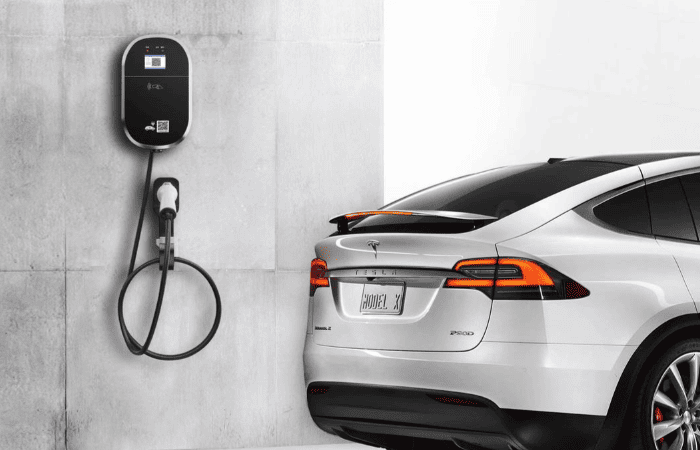

Private investment drives most installations. Tesla and networks like EVgo and Electrify America lead deployments, focusing on high-traffic urban corridors. However, federal programs contributed only 2–3% of new ports in 2025.

Geographic Disparities and Access Gaps

Charging infrastructure is heavily concentrated:

- Urban vs. Rural: 76.5% of urban counties have fast-charging ports, compared to just 45% of rural counties. States like Nevada face severe shortages—only 2,165 ports statewide, forcing drivers to rely on 200+ miles of vehicle range for highway travel.

- State Leadership: California operates 25% of the nation’s charging stations (over 178,500 ports), while states like Wyoming and Idaho lag far behind. California’s aggressive policies—including a $1.4 billion investment in zero-emission infrastructure—propelled this growth.

The NEVI program, designed to fill rural and highway gaps, stalled under federal delays. By 2025, only 58 charging ports were operational nationwide under this initiative, missing its 2030 goal of 500,000 ports.

Policy Shifts and Their Impact

Federal support fluctuated dramatically with changing administrations:

- Biden’s 2021 Infrastructure Law allocated $5 billion to NEVI but deployed just 400 ports by 2025 due to bureaucracy and strict standards (e.g., mandating chargers every 50 miles on highways).

- Trump-era revisions in 2025 unfroze funds after legal challenges but stripped equity-focused requirements (e.g., labor standards and rural/disadvantaged community investments). States gained flexibility to redirect funds, potentially accelerating deployments but risking inequitable access.

Tax credit expirations further clouded progress: Consumer EV purchase incentives ended in September 2025, potentially dampening demand and private charging investments.

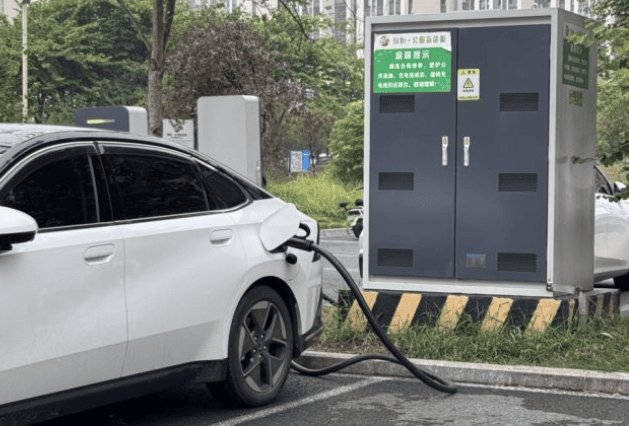

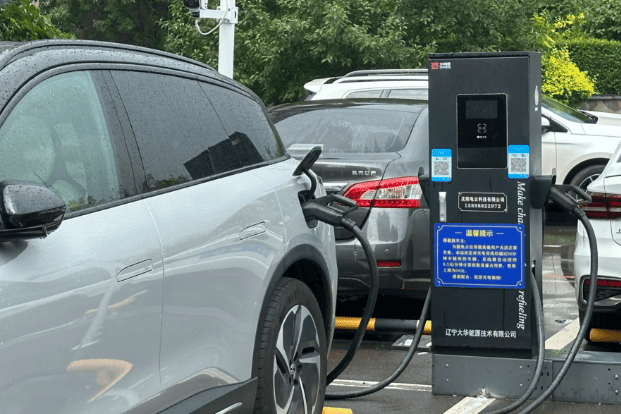

Private Sector’s Role and Innovations

Automakers and utilities are bridging gaps left by policy inertia:

- Tesla’s open-network strategy expanded compatibility with non-Tesla vehicles, while companies like Blink upgraded chargers to support “high-concurrency” use for fleets and ride-sharing services.

- NV Energy’s $100 million Nevada charging project, however, failed spectacularly—completing only 3 of 120 planned stations by 2024 due to poor coordination among state agencies and contractors.

Future Challenges and Projections

Three hurdles persist:

- Scalability: The U.S. needs 1.2 million public ports by 2030 to meet climate goals—six times today’s count.

- Reliability: Fast-chargers suffer 16–25% utilization rates from inconsistent maintenance and fragmented networks.

- Equity: Federal flexibility may sideline rural and low-income areas. For example, Nevada’s highway corridors still lack the federally mandated 50-mile spacing of chargers.

Conclusion: Progress Amid Fragmentation

The network of EV charging stations in the US is growing quickly but unevenly. The majority of gains are driven by private investments and state leadership, particularly in California, while federal programs face political obstacles and inefficiencies. Policymakers and industry must work together to close access gaps, particularly in rural areas and on highways. The wider shift to electric mobility will be slowed down if this isn’t done because range anxiety will continue.